Will the ACA drive up the costs of goods (inflation) and hence nominal interest rates? I’m concerned that it will. Frankly, I’m concerned that they will go up anyway, but that ACA could be the trigger.

I commented about it on Ed Cone’s thread about Hagan/ACA and part of his reply was “and our ongoing low-inflation/low-interest-rate era, and the possibility that reform will slow healthcare cost inflation.”

Maybe I’m wrong, but I think we’re at the bottom of historically low interest rates/inflation. What if ACA marks the end of low-interest rates?

I entered the real estate market in 1991 when the Prime Rate was in the 8’s and 9’s. The 10-year treasury was around 8. I’ve watched Prime and Treasuries bump around. It’s my belief that treasuries are at an all time low and anyone who isn’t locking their rates is gambling. I believe the Prime Rate could increase from 3.25 to 5.5-8% in the next three years.

http://www.moneycafe.com/personal-finance/prime-rate-history/

Likewise, I’m concerned that 10-year treasuries could reach 6-8% over the next few years.

http://finance.yahoo.com/echarts?s=%5ETNX+Interactive#symbol=%5Etnx;range=my;compare=;indicator=volume;charttype=area;crosshair=on;ohlcvalues=0;logscale=off;source=;

The one-year CMT gives us an indication of the historically low rates:

http://mortgage-x.com/general/indexes/cmt_index_faq.asp

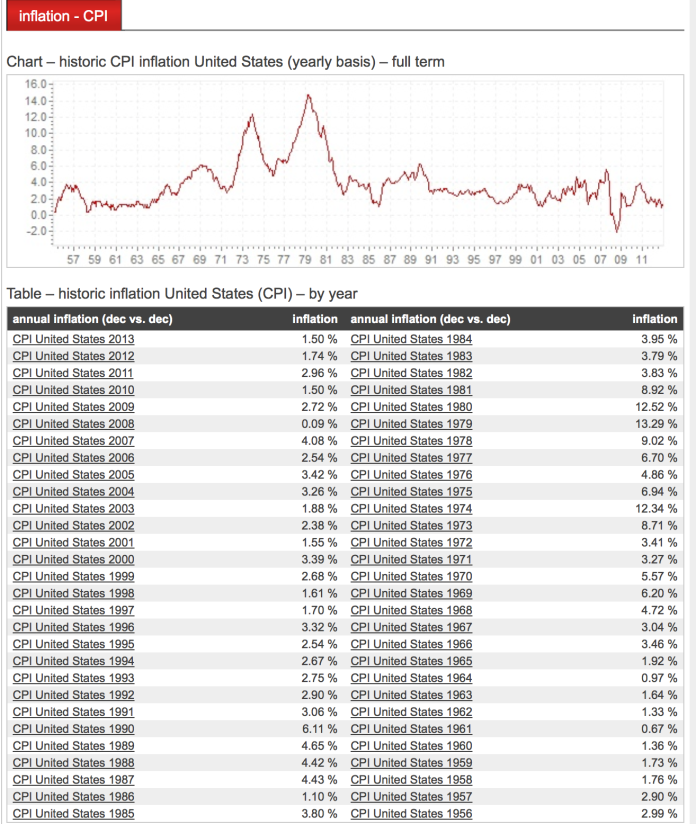

Inflation. I’m concerned that ACA will result in higher cost of goods sold and inflation. I’ve heard business owners talking about the additional costs they will incur by having to provide health insurance. I’ve also seen estimates and had discussions about premiums going up (which would likely have to in order to cover those with preexisting conditions). I believe those costs will be passed on to consumers in the form of higher prices. A jump in prices means inflation. A rate of 3-5% inflation is not out of the question – we only need to look back to 2007 to find 4% inflation or 1990 for 6%. ACA advocates argue that health care costs (which account for 7% of the CPI weight) will decrease, but I haven’t seen any indication of that in the real world.

CPI only looks at consumer paid health care costs, not employee paid. Per BLS CPI Notes – “Since medical care only includes consumers’ out-of-pocket expenditures (and excludes employer provided health care), its share in the CPI is smaller than its share of gross domestic product (GDP) and other national accounts measures.”

It may make CPI for medical costs look good, but shifting dollars around from the consumers to their employers, medical providers or government – doesn’t make the cost magically disappear. Those costs will reappear in other areas.

http://www.inflation.eu/inflation-rates/united-states/historic-inflation/cpi-inflation-united-states.aspx

Interest Rates. With inflation comes higher nominal interest rates as they are the sum of the real interest rate and inflation. I’m concerned that interest rates will rise over the next few years. As interest rates rise, the cost of products and services will rise as well. That leads to even higher inflation.

Stock Market Adjustment? A high interest rate environment would have devastating effects on the economy and stock market. I’m a bear anyway, but I believe a shift in interest rates could topple the market highs.

In summary, I’m concerned that ACA will increase the cost of goods, drive up inflation, and increase interest rates.

What are your thoughts? The comments section is at the bottom of the page.

My Comments from Ed’s Thread –

I think the price increases will be a little more spread out, as all businesses won’t alter prices all at once. But if we see a significant short term pop in inflation, the associated interest rate movement may be enough to increase prices again. That could compound. Think of it as a balloon that’s been popped. What are your projections for inflation and interest rates in the next 5 years?

I also agree that ACA will cause some employers to re-trade wages or shift from full-time to part-time staff. Any projections on that impact?

I’ve read much of the White House’s argument that health care costs are under control – http://www.whitehouse.gov/sites/default/files/docs/healthcostreport_final_noembargo_v2.pdf

But most business people I know are seeing health insurance premiums increase substantially. So I’m just not seeing the reductions in healthcare inflation on a local level. On the ground in Greensboro, are you seeing health care costs go down?

As far as the broader health care pool, it really depends on who’s in that pool. What’s the data showing? Some surveys show that only 11% of those who signed up were uninsured before. So what are the numbers for the broader health care pool?

Andrew and Ed – I’m asking these questions and commenting because I really am interested in your opinions on the topic.

I’m bearish on the stock market too, because of QE easing mostly, but also because of slowing growth due to a stagnant middle class consumer. I don’t think the ACA is much of an inflationary threat because, even if it adds costs to businesses, and that’s debatable, there is plenty of slack in labor costs. In fact, didn’t I read that labor unit costs last quarter actually declined by some astonishing number like 1.8%? With a soft labor market and continued increasing productivity I don’t think the costs of the ACA will be inflationary.

As to interest rates, I think you are probably right — eventually. When the stock market retreats, I think it will help bonds rally and keep rates low for a while longer though.

Productivity and efficiency of labor (and the impact of technology) and how they compare to other markets could be a thread by itself. The labor decline may also be tied to anticipated ACA costs and the unemployed vigorously seeking jobs. Of course, per Ed’s comments, we’re only speculating 😉

It’s funny, in all of this, I really hope I am wrong and just overly cautious.

Ok – so focussing on access, coverage and priorities – per Ed’s request:

EC”My thinking still starts with the need to get pretty much everyone into the risk pool for services they will almost certainly use”

-If that is your objective, then I think you’re talking about national socialized medicine. My concern about ACA is that people who need it will sign up and people who don’t won’t. With the preexisting conditions component of ACA, why would anyone sign up until they actually think they need it. I also get confused by the ACA proponents thinking on geographic scope – why national and not international or local or state level?

EC”Do you think we should deny all care to people without the means to pay for it?”

I believe people should have significant freedom to prioritize their own needs. In a perfect world, everyone would have food, shelter, safety, education and be healthy. But that “ranks up there with mom and apple pie on the list of things we all love.” I also believe that others should have the freedom to give to those in need – wherever they may be in the world and for whatever that person feels is a priority. That’s where the charity concept comes in.

“All care” is also an extreme. I believe that we already provide a fair amount of care through local, state, and federal programs. Perhaps you could clarify what you mean by “all care”.

EC”If you don’t think that, then do you prefer the system the ACA is trying to fix (uninsured people get access in an inefficient, unhealthy, and expensive way, with the costs dumped on private insurance plans, the government, and charity)?”

-A federal government solution isn’t the only solution. A greater coordinated effort between charities, govt agencies and health care providers would go a long way. I don’t think the current system is efficient, but I feel that way about most bureaucracies. I’d like to see an overhaul of of all government as well as zero-based budgeting and a discussion of ROI. In general, I believe in smaller government.

EC”If you don’t want the status quo ante, what would you like to see? Do you agree that universal access demands some sort of universal coverage? If so, what would it look like?”

-A multi-prong approach. 1) a primary charity that can decide how best to use its funds to impact the most people (the big question become scope and geography), 2) sub chapters of the charity that are focussed on certain health care issues or specific regions/priorities, and 3) a private system that allows those that want high quality health care to get it. And more thinking in terms of global solutions, not just national.

EC”As I asked you before, what’s your take?”

-I’d like to see an end to suffering in the world, but wouldn’t we all. So then you get to the idea of who do you help, what help you provide and how to pay for it. If I choose to help a starving child in South Africa versus a smoking induced lung cancer patient in Minnesota, that should be my choice. If some choose to spend their money on a performing arts center in Greensboro, well that’s their choice. What I don’t like the idea of is someone else deciding which causes/charities I should support.